Handful of options looked at during meeting on May 22

A citizens’ panel on the decommissioning of the Diablo Canyon Power Plant heard potential re-use scenarios for one portion of the expansive coastal lands, with a handful of options being looked at. And from the presentations offered by the experts, energy-related uses could play a large role.

The Diablo Canyon Decommissioning Engagement Panel was in Atascadero on Wednesday, May 22, to hear what government agencies and the company are doing to prepare for the eventual closure and removal of the power plant andthe potential uses for offshore wind energy was a focus.

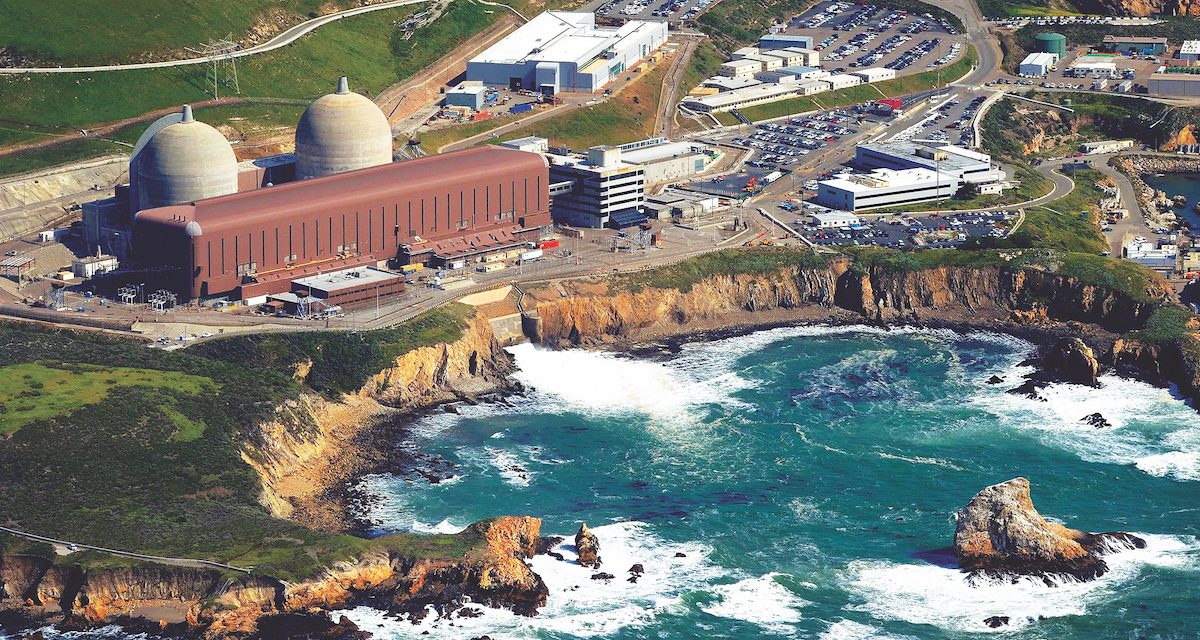

Plant owner Pacific Gas & Electric’s (PG&E) spokesman, Tom Jones, ran down the complex nature of “Parcel P,” the specific area where the nuclear reactors, power building, marina, desalination plant, waste storage, and administration building, among other structures, sit.

Overall, the lands surrounding the plant cover about 12,000 total acres, and include a variety of land types: pasturelands, oak woodlands, coastal bluffs, and mountains with coastal dune scrub habitats.

Each area has its own unique set of issues to deal with, from Native American archaeological and historic sites, protected ag lands, and the coast, which includes numerous offshore rocks and reefs.

Jones noted the potential for re-using the small manmade marina, which is protected by breakwaters. With a little workit could accommodate some of the needs for the offshore floating wind turbine projects being developed now for a nearly 400-square-mile patch of open ocean 20-30 miles off San Simeon.

Floating offshore wind

Three offshore leases were auctioned off by the Bureau of Ocean Energy Management (BOEM) to three different companies, each intending to produce 1 gigawatt of capacity and 3 GWs total.

Diablo Canyon’s 230,000 volt (230KV) and 500KV transmission lines could be re-used to connect the offshore energy to the state power grid.

There’s the potential to transmit 6 GW of power through the existing transmission lines, Jones said, and Diablo Canyon uses 2.5 GW now. So there is capacity now on the existing lines, which generally cost about $1 million a mile to string on land.

One of the sticky problems with the offshore floating wind farms is the needed harbor facilities: a deep-water port andmassive portside assembly and maintenance facility, plus port facilities for smaller maintenance vessels.

Diablo Canyon’s harbor is over 30 feet deep and with a bit of dredging, it could be deepened, Jones explained. He said PG&E could save $400 million if it could find a new use for the marina and not have to remove it when the plant closes.

“And it would give California a new public harbor,” Jones said.

Offshore wind (OSW) also might be able to re-use some of the support structures at the plant and if needed they have about 30 more acres that could be developed on Parcel P.

Jones cautioned that the OSW talk is premature. PG&E hasn’t seen any plans, he said, and they don’t know at this time what their requirements are.

He added that at least two universities — Cal State Long Beach and Cal Poly SLO — have toured the plant with an eye towards potentially setting up an ocean research facility.

BESS on minds

A proposed battery storage plant in Morro Bay came up early. Panel member Dave Houghton asked about the BESS project in Morro Bay, and if there might be room at Diablo Canyon for that project, instead of the old Morro Bay Power Plant property.

Jones replied, “You certainly could.” He said the company’s potential re-use scenarios previously announced, includesbattery storage built on the plant’s parking lots.

The Morro Bay BESS is being sited on a 22-acre former oil tank farm on the 100-acre-plus Morro Bay Power Plant property.

County review

The SLO County Planning Department’s Susan Strachen ran down the county’s work on the July 2023 Environmental Impact Report for the decommissioning.

That draft EIR (DEIR) lists eight possible re-use concepts for Parcel P: a clean technology industrial park, recreation uses like camping and a resort hotel, energy storage, energy research, institutional uses (university), cultural and historic preservation, a desalination plant, and a “Central Coast Offshore Wind Area.”

A cleantech innovation park, she said, could be a mixed-use facility with clean energy research and development, marina (blue economy), a Chumash community center, expansion of the deal plant to add to the county’s water supply, and education.

She cautioned that this was for informational purposes only and they’ve done no analysis on the feasibility of any of these re-use ideas.

The options were mined from studies conducted by others, including the Decommissioning Panel’s own strategic vision statement, a report from Friends of Diablo Canyon Lands aimed at conserving the property, PG&E’s plant repurposing and re-use report, a report from REACH (a citizen’s economic development group), and from public comments gleaned during the county’s DEIR process.

Of these, the resort hotel and recreation idea seemed the biggest change, as this could include a main lodge, with cabins, yurts, tent camping areas, or “moderate intensity camping,” she said.

Strachen added that it could also include an amphitheater, restaurants, stores, and conference rooms.

Currently, they are in the process of writing responses to all the comments they received on the DEIR and the goal is to release a final EIR by the end of this year, she said.

The DEIR for the decommissioning of Diablo Canyon is posted on the County Planning Department’s website at slocounty.ca.gov/DCPPDecom.

Blowin’ in the wind

Panel facilitator Chuck Anders turned the discussion over to three speakers with a focus on the wind energy projects.

Matthew Blazek, a renewable energy specialist with BOEM, ran down that agency’s process for leasing the Morro Bay call area off San Simeon. The idea was first hatched in 2016.

BOEM takes one to two years for its planning and analysis stage, Blazek explained. It includes forming a task force among government agencies, putting out a call for information and “nominations,” identifying a location and conducting preliminary environmental reviews. Stage 2 involves the leasing work.

Blazek said leasing is a one- to two-year process involving publishing notices (in the Congressional Record), conducting the auctions, and negotiating terms for leases.

The three winning companies are Central California Offshore Wind, LLC, which bid $150.3 million for 80,418 acres of the wind area; Equinor Wind US, LLC ($130 million, 80,062 acres); and Invenergy California Offshore, LLC ($145.3M, 80,418 acres).

The Morro Bay call area has already been through BOEM’s first two stages and is currently doing site assessment.

Officially, site assessment is broken into site characterization and site assessment plan, but Blazek said there’s a lot more to it. The companies must also come up with a “tribal” plan, essentially an agreement to address any Native American issues that might come up, and BOEM is also working on an environmental review.

Equinor, he said, has already started surveying the seafloor at the call area, which is in federal waters out past 3 miles from shore.

On a side note, Equinor recently withdrew an application it had before the Coastal Commission asking for a “de minimis” permit to conduct sound wave mapping in state waters — inside 3 miles from shore.

Though the call area is in federal waters, the transmission cables (export cables) will have to run through state territory, so a permit is needed from the Coastal Commission.

The commission’s executive director was ready to approve the scaled-down review, but the company instead pulled the item and issued a statement that said they would re-apply for a full Coastal Development Permit process.

That’s a complicated and often lengthy process that can take a couple of years to navigate.

Though the transmission route is the state’s responsibility, Blazek said they are also working with the California Department of Energy on potential OSW leases in state waters. That’s something that has recently cropped up as a goal by the state, installing wind turbines near shore, up and down California. BOEM’s site analysis could take six years.

The fourth stage of BOEM’s process is construction and operations. This, too, is multi-faceted.

The companies must write construction and operations plans; design, fabrication and installation reports; a decommissioning plan; and environmental and technical reviews, a process that typically takes another three years.

BOEM agrees the port siting is crucial, and will be expensive. Blazek said they’ve done a port assessment study andDiablo Canyon has potential for an operations and maintenance port. The offshore wind port sites will require a great deal of money, he said, up to $50 million, with a timeline of as much as seven years — construction taking three years.

Diablo Canyon’s marina could need $10 million in upgrades, according to a chart Blazek presented.

That would be to “upgrade for operations and maintenance needs,” he said. And all this “has to be ready by the late 2020s to early 2030s.”

He added that at this time, “No decisions have been made on California ports.” As for the State’s OSW dreams, he said the goal is to develop 25 GW of capacity by 2035.

Boosting the power grid

This will also require work on the power grid, in particular high voltage transmission lines. Jeff Billinton, California Independent System Operator’s director of transmission infrastructure planning, said they have been working on an overall plan for how these future developments would tie in with the power grid and where and how much additional transmission capacity might be needed to meet the state’s goals.

Cal-ISO has a Memorandum of Understanding with the Energy Commission and the Public Utilities Commission to work on the transmission and grid system.

Their MOU was updated in 2022 and “offshore wind is a component,” Billinton said. He said they’re planning for some 85 GW in renewable energy sources — solar, wind, offshore wind, geothermal — across the state.

“Now it’s just Morro Bay and Humboldt,” Billinton said. Potentially in the future, they could also have the wind turbines offshore in Mendocino County. Right now they’re planning for 3,100 megawatts (3.1 GW) for the Morro Bay call area, but there’s potentially more possible.

Billinton said if the call area’s capacity grows above the current 3 GWs, or if Diablo Canyon stays open for 20 more years, “it would require adding transmission lines to both” Morro Bay and Diablo Canyon.

Where it will be added depends on where the OSW power comes ashore. When it comes ashore there will need to be switching equipment put in to step the power up so it transmits on the grid. Billinton said this would need 5-10 acres of land or up to 12 acres.

East Coast example

The panel also heard from Dr. Divya Kuthakoti, an engineer with Orsted, an offshore wind company working on the East Coast. There, she said, the turbines are embedded in the seafloor and not floating, as is proposed for here.

A typical wind farm on the East Coast has the turbines’ transmission cables buried in the seafloor, rising up to a floating substation, and then buried again all the way to shore, usually coming up again at another substation some distance inland.

Each layout is site specific, she said, and depends greatly on acquiring rights of way from landowners, as well as the type of substation being used. Gas-cooled substations can be stacked but air-cooled equipment requires more area.

She noted the South Fork Wind Farm off New York. That 130 MW wind farm is the first commercial-scale offshore wind farm in federal waters (see southforkwind.com).

GO-BIZ is busy

Danna Stroud, who is with the Governor’s Office of Business and Economic Development, or GO-BIZ, said the funding for their efforts is coming out of Senate Bill 846, which authorizes Diablo Canyon to remain in operation for another five years, and includes provisions calling for plans for the eventual re-use of the Parcel P.

Her office is working on that aspect of SB 846, and she said they are planning to go out for bids for a consultant to write the plan, probably sometime this fall.

She said the plan is to go public with the Request for Proposals in late July or early August, and to solicit bids in August-September. The goal is to be ready to award a contract in October or early November.

They have a target date of Spring 2026 to complete this planning, as the $5 million in funding from SB 846 runs out that October.

She said their goal is to figure out how Parcel P could be re-used to “create the good paying jobs.” She added that their focus is on re-uses that “align with economic sectors that are emerging on the Central Coast.”

Panel member Linda Vanasupa asked where Native Americans, who have first right of refusal on the re-use, fit in these plans?

Stroud said she was not in a position to respond to that at this time.

PG&E’s Jones said that was “not binding” in part because Parcel P isn’t actually owned by PG&E, but the utility leases Parcel P from Eureka Energy.

If they could sell off the facilities for re-use it would save PG&E’s customers money, which Jones said could lead to rebates on energy bills. The customers could get something out, Jones said, if they put it in.

Panel member Linda Seeley confessed to being a little confused. It was as if they were “in a parallel universe,” she said.“We’re assuming Diablo Canyon shuts down in 2030, which seems unrealistic. We’re talking about so many different things at the same time.”

Stroud pointed out that GO-BIZ doesn’t operate any facilities or companies. It is the lead state agency on economic goals and development.

“There were concerns with Diablo Canyon closing,” Stroud said, “and how would the region recover or sustain itself without Diablo Canyon.” They are charged with looking at re-use of Parcel P and in overall economic development.

“Everyone has ideas,” she said. “Our intent is to explore the feasibility for the different ideas.”

The panel has a website where readers can access the various studies, plans and other work that has been done with regards to Diablo Canyon’s future re-uses, at diablocanyonpanel.org.